Rabbit Finance

Rabbit Finance is a mining super profit protocol that supports 10x leverage

Hello everyone, I'm here to let you know by writing a review to introduce a truly unique new platform that is Rabbit Finance, so for that, read the article I created below to give you an overview of all that tent pro temp baipa. . The benefits they provide to everyone.

Rabbit Finance is a Binance Smart Chain (BSC) based agricultural product protocol released by Rabbit Finance Lab. It supports users participating in liquidity farming through excess borrowing plus leverage to earn more income.

When users have insufficient funds but want to participate in DeFi's liquidity farm, Rabbit Finance can provide up to 10X the leverage to help users earn maximum revenue per unit of time, and at the same time provide loan pool for users who prefer stable returns. to make a profit.

What is Rabbit Finance?

Rabbit Finance is a Binance Smart Chain (BSC) based agricultural product protocol released by Rabbit Finance Lab.

When users do not have sufficient funds but want to consider DeFi's liquidity farm, Rabbit Finance can provide leverage of up to 10x to help users achieve maximum revenue per unit of time while providing buy-out-buy-out-check-out-check-out---------------------------------------. Perform---------------------doing. Make-out-to-do-----------'s-------------------------------------------------------------------ise it's their-their--------------'s -'s -'s -'s -'s -'s -'s -'s -'s -'s -'s-----------------------------------------------'d-----------themselves themselvesââ-their-ââ like their-ââ like their-ââ like their- â ââ?

While the predecessors of this field such as Link, COMP, and BAL struggled alone, Rabbit Finance, which was lagging behind, began to push for resource integration to be unique by the rest of Defi.

How to Participate?

1. As a user, you can participate in Rabbit Finance in four different ways:

- Lenders: Rabbit Finance allows you to earn income on your basic assets by depositing them in our vaults. These assets will then be offered to yield farmers to increase their position.

- Farmers: As a farmer, you can get higher yields by opening a leveraged position with Rabbit Finance. Of course, this comes with a bigger risk: liquidation, variable losses, etc.

- Liquidators: Monitor ponds for underwater positions and liquidate them when they become too risky.

- Bounty Hunter: Prize hunter in pool and execute reinvestment, 30% of bounty pool is used as buyback fund to promote token value. For this service, he takes 0.4% of the bounty pool as a reward, the remaining 69.6% will be converted into pool LP and promises again to get a combined return.

At launch, we will support the two basic assets of BNB and BUSD, and integrate our leveraged farm with PancakeSwap.

2. In the example below, we show how each participant works together in our ecosystem:

- Cora, the lender deposits his BNB in our safe; the assets are available for borrowing by yield farmers; he earns interest for providing this liquidity.

- Dunn, the yield farmer wants to open a leveraged yield farm position in the BTC / BNB pair; he borrowed BNB from the vault and enjoyed higher yielding agricultural produce.

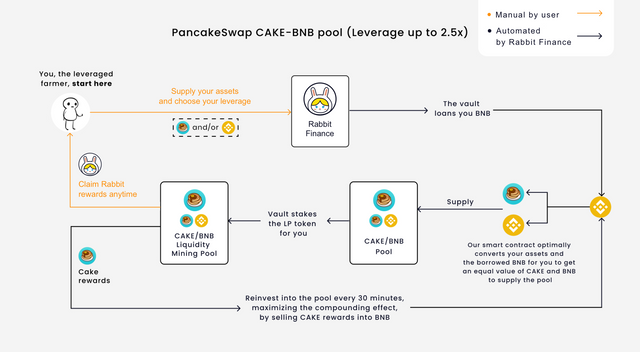

- Rabbit Finance smart contracts handle all the behind the scenes mechanisms optimally transferring assets to the right ratio, providing liquidity to the pool, and staking LP for Pancake Rewards

- Gary, the liquidator monitors the health of each leveraged position, and when it goes beyond the prescribed parameters, he helps to liquidate the positions, making sure the lender doesn't seem to lose his capital. For this service, he takes a 5% reward from liquidated positions.

- Bounty hunter James keeps track of the amount of bounty earned in each batch and helps reinvest it, combining returns for all farmers. For this service, he takes 0.4% of the prize pool as a reward. 30% as buyback funds, which will be used for RABBIT buyback and deflation. The remaining 69.6% will be converted into LP from the pool and guaranteed again to get multiple returns.

The definition of ecology, in Rabbit Finance, ambitiously includes modules such as lever gun pool + arithmetic stablecoin, NFT + arithmetic stablecoin. For Rabbit Finance, they hope to build Defi's ecology through a combination of simple and interconnected functions.

Distribution

- Community pool: 79.75% of the total supply , about 159,500,000 RABBITS.

RABBIT will be released for two years on an emission reduction schedule, and will be distributed evenly throughout the ecosystem as a community reward. - Institutional pool: 5.25% of the total supply, 10,500,000 KELINCI

Provide investment quota of 5.25% to well-known institutions and investors. After the investment is complete, 245,000 RABBIT will be released every 7 days and 10,500,000 RABBIT will be released within 300 days (about 10 months). Specific time to be determined, please pay attention to the tracking announcement.

Rigid hat: 10,500,000 RABBIT = 525,000 USDT

Exchange rate: 1 RABBIT = 0.05 USDT

- Warchest Fund: 5% of the total supply, around 10,000,000 RABBIT.

5% of the tokens distributed are reserved for future strategic spending. In the first month, 250,000 tokens are released for registration, auditing, third party services, and partner liquidity fees.

Development Fund: 10% of the total supply, around 20,000,000 RABBIT

10% of the tokens distributed will be used to fund team development and expansion, and will be subject to a two-year award equal to the tokens in the fair launch distribution.

The

RABBIT Token community collection release program will be released over a two year period with a reduced publishing schedule and will be distributed evenly throughout the ecosystem as a community reward.

In total, there will be 159,500,000 RABBITS. In order to attract early adopters, there will be a bonus period for the first few weeks. Below is our planned block reward schedule. On this basis, the circulating profile of the RABBIT supply can be drawn.

Bonus period

- Open the safe and the money pancakewap pool.

- Users can start storing their assets in our vault.

- We planted the RABBIT-ENB PancakeSwap so people could get their hands on their rabbits right away.

- This phase is designed to ensure we have a good amount of loanable assets and liquidity to trade rabbits for the next phase.

- Make sure you give everyone enough preparation time, we will start distributing the prizes in blocks of xxxx,000 (around April 8, 2021, 00:00 UTC).

The rabbit allocation plan will be updated as follows:

- 52% distributed to liquidity providers for the RABBIT-BNB pool at PancakeSwap

- 48% distributed to lenders who deposit BNB or BUSD and other tokens in our vaults - prizes will be divided equally among the pool

Officially

launched Launching leveraged yield farming, farmers can open leveraged yield farming positions and earn RABBIT prizes.

- When we complete our smart contract audit, we'll unlock the leveraged farming function, thus completing our round of services. Our current estimate is the end of April 2021

- We will make a separate announcement to the community first before launching phase 2

The bonus period lasts approximately one week, after the project officially starts, the Rabbit allocation plan will be updated as follows:

- 40% is distributed to liquidity providers for the RABBIT pool at PancakeSwap

- 25% distributed to lenders who deposit BNB or BUSD and other tokens in our vaults - prizes will be divided equally among the pool

- 35% is distributed to users who open leveraged agricultural positions - the prize will be calculated based on the loan amount; only leveraged positions (> 1x) will receive the prize.

To conclude

Rabbit Finance fully utilizes and adopts the advantages of projects in the market, using over-leveraged agricultural products with the advantages of Alpaca Finance and Badger Finance, creatively incorporating an algorithm-stable coin mechanism to empower the RABBIT token. Across the economic ecology of Rabbit Finance, the RABBIT token, endowed with more application scenarios, represents not only the governance rights and interests of the leveraged farming protocol, but also the rights and interests of token shareholders of the RUSD algorithm stable coin.

Rabbit Finance can provide leverage of up to 10X to help users earn maximum income per unit time, and at the same time provide a pool of loans for users who prefer stable returns to make a profit.

For more information:

Rabbit Finance website: http://rabbitfinance.io/

Github: https://github.com/RabbitFinanceProtocol

Twitter: https://twitter.com/FinanceRabbit

Telegram: https://t.me/ RabbitFinanceEN

Discord: https://discord.gg/tWdtmzXS

Contract information: https://app.gitbook.com/@rabbitfinance/s/homepage/resources/contract-information

Username: Trenggalex

Link: https://bitcointalk.org/index.php?action=profile;u=3198662

Komentar

Posting Komentar